Things about Top 30 Forex Brokers

Things about Top 30 Forex Brokers

Blog Article

The 8-Minute Rule for Top 30 Forex Brokers

Table of ContentsNot known Details About Top 30 Forex Brokers Fascination About Top 30 Forex BrokersOur Top 30 Forex Brokers DiariesTop Guidelines Of Top 30 Forex BrokersFascination About Top 30 Forex BrokersGetting My Top 30 Forex Brokers To WorkSee This Report on Top 30 Forex BrokersSome Ideas on Top 30 Forex Brokers You Need To Know

Each bar graph stands for one day of trading and has the opening rate, greatest cost, most affordable cost, and closing rate (OHLC) for a profession. A dash on the left represents the day's opening price, and a comparable one on the right represents the closing price.Bar graphes for currency trading aid investors identify whether it is a customer's or seller's market. The top part of a candle is utilized for the opening price and highest possible cost factor of a currency, while the reduced part shows the closing cost and lowest rate point.

The 10-Second Trick For Top 30 Forex Brokers

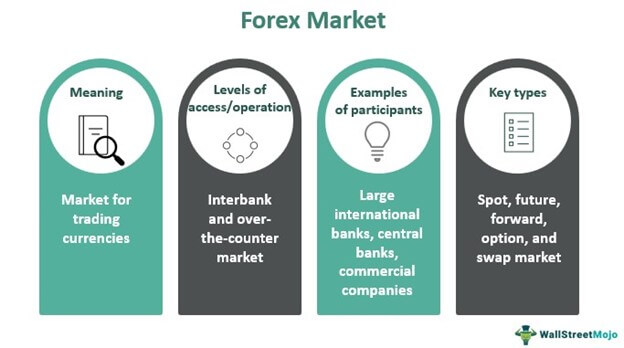

The formations and shapes in candle holder graphes are made use of to determine market direction and activity. Several of the more typical developments for candle holder charts are hanging man - https://www.easel.ly/infographic/c39nss and shooting star. Pros Largest in regards to day-to-day trading quantity on the planet Traded 24 hours a day, five and a fifty percent days a week Starting resources can quickly multiply Usually complies with the same guidelines as regular trading More decentralized than traditional stock or bond markets Tricks Take advantage of can make forex professions really volatile Leverage in the series of 50:1 prevails Calls for an understanding of economic principles and signs Less regulation than various other markets No earnings creating tools Forex markets are the largest in terms of day-to-day trading quantity worldwide and therefore supply one of the most liquidity.

Financial institutions, brokers, and dealerships in the foreign exchange markets permit a high quantity of take advantage of, indicating traders can manage huge settings with reasonably little money. Utilize in the variety of 50:1 is usual in forex, though even greater amounts of leverage are available from certain brokers. Leverage must be utilized meticulously since numerous unskilled investors have experienced substantial losses utilizing even more utilize than was needed or prudent.

The Ultimate Guide To Top 30 Forex Brokers

A money trader requires to have a big-picture understanding of the economic situations of the numerous countries and their interconnectedness to grasp the principles that drive currency values. The decentralized nature of forex markets implies it is less regulated than other financial markets. The extent and nature of regulation in forex markets rely on the trading territory.

The volatility of a particular currency is a feature of multiple variables, such as the national politics and economics of its nation. Occasions like economic instability in the form of a payment default or imbalance in trading connections with another currency can result in substantial volatility.

Not known Details About Top 30 Forex Brokers

Money with high liquidity have a ready market and show smooth and predictable rate activity in response to outside events. check these guys out The U.S. dollar is the most traded currency in the world.

The Basic Principles Of Top 30 Forex Brokers

In today's information superhighway the Forex market is no longer entirely for the institutional investor. The last 10 years have seen an increase in non-institutional traders accessing the Forex market and the advantages it supplies.

The Only Guide to Top 30 Forex Brokers

International exchange trading (forex trading) is an international market for getting and marketing currencies - FBS. 6 trillion, it is 25 times larger than all the world's supply markets. As an outcome, prices transform continuously for the currencies that Americans are most likely to utilize.

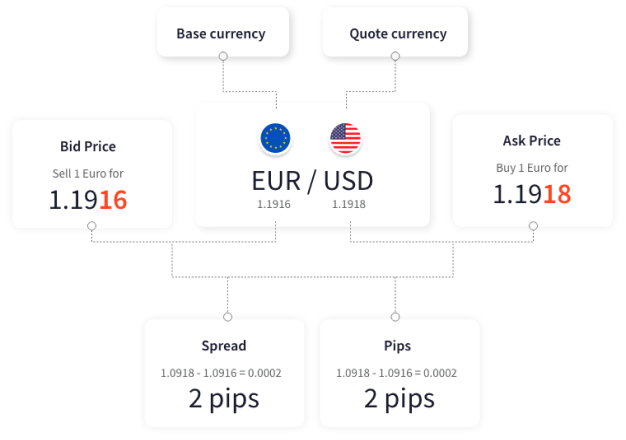

When you offer your currency, you receive the settlement in a different currency. Every vacationer that has gotten international money has done forex trading. The investor acquires a particular money at the buy price from the market maker and markets a different currency at the marketing price.

This is the purchase expense to the investor, which consequently is the profit gained by the market maker. You paid this spread without understanding it when you traded your dollars for international currency. You would certainly discover it if you made the purchase, canceled your journey, and then attempted to trade the currency back to dollars right now.

Top 30 Forex Brokers for Dummies

You do this when you assume the currency's worth will fall in the future. Businesses short a currency to secure themselves from risk. But shorting is really risky. If the money climbs in worth, you have to purchase it from the dealership at that rate. It has the exact same benefits and drawbacks as short-selling supplies.

Report this page